Build options income in 2026 with practical strategies, real scenarios, and clear risk control—without relying on perfect market timing.

Options income attracts traders who want cash flow instead of constant prediction. Rather than guessing whether a stock will surge or crash, income-focused strategies aim to get paid for time and probability. Still, this approach isn’t “easy money.” The risks are real, just different from directional trading.

For example, a trader selling options on a stable stock may collect steady premiums for months. However, one sharp move can turn comfort into stress if risk isn’t defined. Understanding how income strategies actually work is the difference between consistency and surprise losses.

What Options Income Really Means

Options income means earning premiums by selling options, not buying them. As a seller, time decay works in your favor. If price behaves reasonably, the option loses value and you keep the premium.

Common income-focused approaches include:

- selling calls on stocks you own

- selling puts on stocks you’re willing to buy

- using spreads to limit risk

If you’re new to options mechanics, reviewing an options risk guide helps clarify why sellers face different challenges than buyers.

Why Options Income Feels More Predictable

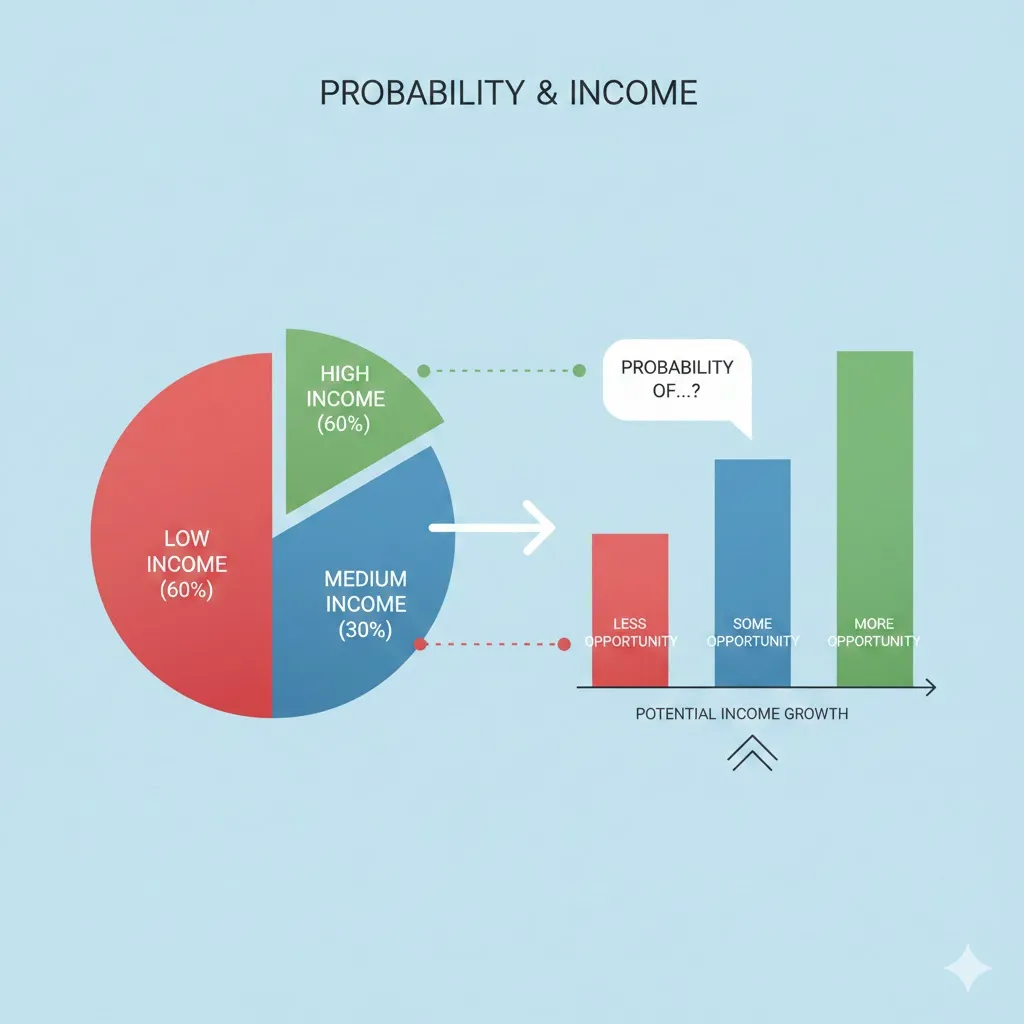

Income strategies rely on probability. You don’t need a big move. You often just need nothing dramatic to happen.

Real-life micro-scenario:

An investor sells a covered call on a stable dividend stock. The stock moves sideways for weeks. The option expires worthless, and the premium becomes income—without needing perfect timing.

That predictability is why many traders prefer income over chasing breakouts.

Popular Options Income Strategies Explained

Covered calls

You own the stock and sell a call option against it. This generates income but caps upside.

Cash-secured puts

You sell a put while holding enough cash to buy the stock if assigned. It’s often used to enter positions at lower prices.

Credit spreads

You sell one option and buy another further out. This limits risk while still collecting premium.

These strategies are often chosen because losses are defined or planned, not open-ended.

Options Income vs Directional Options Trading

| Feature | Options Income | Directional Options |

|---|---|---|

| Main goal | Collect premium | Bet on price movement |

| Time decay impact | Helps you | Hurts you |

| Win rate focus | Higher probability | Lower probability |

| Stress level | Often lower | Often higher |

| Skill emphasis | Risk control | Timing & speed |

This comparison shows why income strategies appeal to traders who value steadier results over excitement.

The Risks People Underestimate

Options income is not risk-free. The danger usually appears when markets move fast.

Assignment risk

You may be required to buy or sell stock unexpectedly.

Gap risk

Overnight news can push prices beyond planned levels.

Overconfidence

Selling “easy” premium repeatedly can lead to oversized positions.

That’s why many income traders rely on strict rules and position sizing. A risk management checklist mindset still applies, even outside crypto.

Pro Insight

Consistent options income traders think like insurers. They focus on surviving rare bad events, not maximizing every good month.

How to Build Options Income More Safely

Trade liquid underlyings

Tight bid-ask spreads reduce hidden costs.

Keep position sizes small

Many small wins beat one oversized position.

Respect volatility

Higher volatility means higher premiums—but also higher risk.

Accept capped upside

Income strategies trade excitement for consistency.

If you want a smoother learning curve, comparing options income with tools like 3x ETFs highlights how different risk profiles feel in practice.

Quick Tip

If a premium looks “too easy,” reduce size. High premiums often signal hidden risk.

FAQs About Options Income

Is options income suitable for beginners?

It can be, if strategies are defined-risk and position sizes stay small.

Can options income replace a salary?

Some traders aim for steady cash flow, but results vary and require discipline.

Do options income strategies work in all markets?

They work best in sideways or mildly trending markets. Sharp moves increase risk.

Is assignment always bad?

Not always. Assignment can be part of the plan, especially with covered calls or cash-secured puts.

How often do income traders place trades?

Many trade weekly or monthly, focusing on quality setups rather than frequency.

Disclaimer

This article is for general informational purposes only and does not provide financial, legal, or investment advice. Options trading involves risk, and outcomes depend on individual decisions and market conditions.