Build long-term wealth with IRA investing in 2026 using simple strategies, smart tax timing, and steady habits that reduce stress and reward patience.

IRA investing doesn’t shout for attention. It quietly compounds while headlines come and go. In 2026, with markets still sensitive to rates, geopolitics, and fast-moving trends, this calm approach remains one of the most reliable ways Americans prepare for retirement without constant second-guessing.

If you’ve ever felt overwhelmed by investing noise, IRA investing offers a slower, steadier path—by design.

Why IRA investing keeps working when emotions run high

IRA investing is built for time, not timing.

Picture a 35-year-old operations manager who sets monthly auto-contributions and checks the account once a year. During downturns, nothing changes. During rallies, nothing changes either. Over a decade, the account grows because behavior stayed boring.

That’s the advantage. IRA investing reduces impulsive decisions and replaces them with structure—something markets can’t take away.

Traditional IRA vs Roth IRA without the confusion

The real difference between these two isn’t complexity. It’s when taxes show up.

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax timing | Later, in retirement | Upfront, before investing |

| Withdrawals | Taxed | Tax-free |

| Required distributions | Yes | No |

| Often suits | Higher earners now | Early or rising earners |

Someone early in their career often favors Roth flexibility. Someone earning at their peak may prefer the current-year deduction of a Traditional IRA. Many long-term planners quietly use both.

What actually belongs inside an IRA

An IRA is a container. The contents matter more than the label.

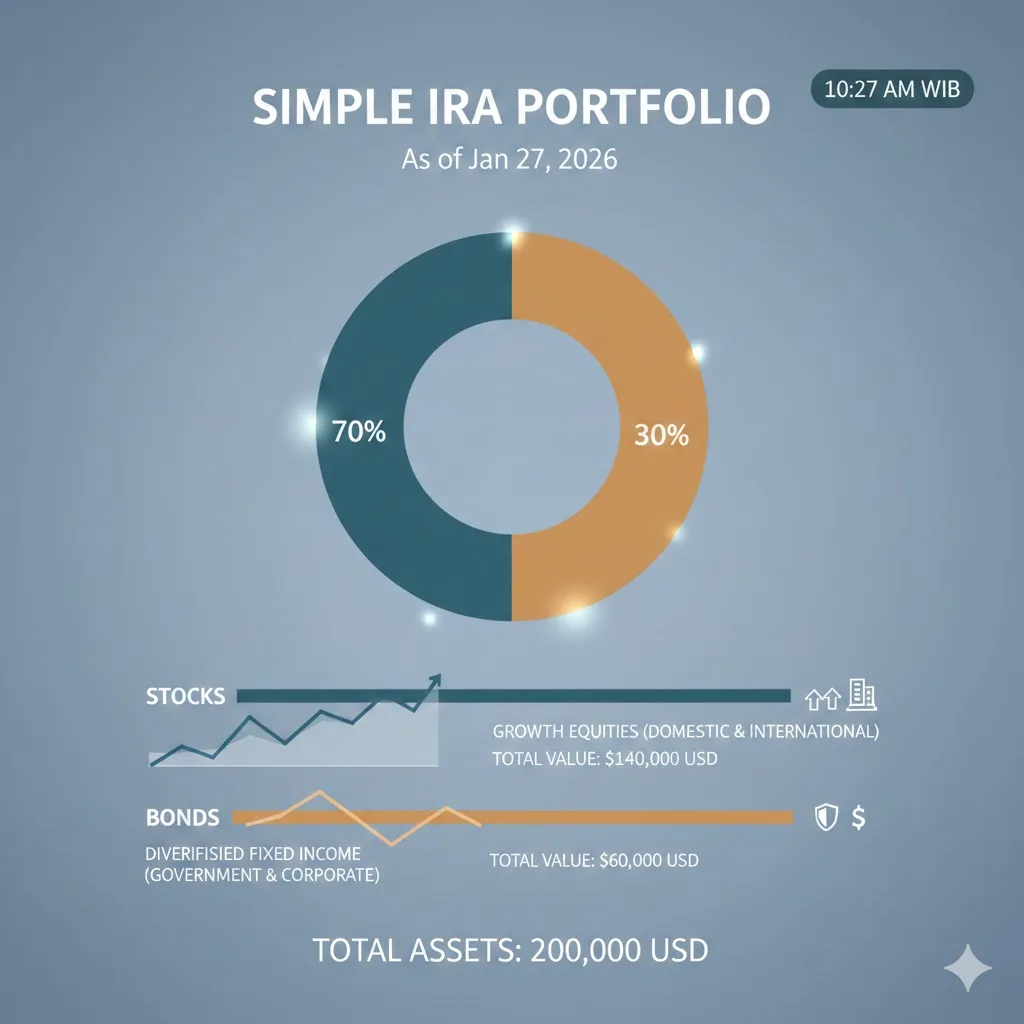

Most successful long-term investors keep it simple: broad-market index funds, low-cost ETFs, and bonds for balance. Complexity rarely improves outcomes here.

Consider a real scenario: a healthcare worker splits contributions between a total-market ETF and a bond fund, rebalances annually, and ignores daily market chatter. The strategy works because it’s sustainable.

This approach pairs naturally with long-term retirement planning frameworks that prioritize consistency over prediction.

Contribution rules that matter for IRA investing in 2026

IRA contribution limits are adjusted periodically, and income thresholds can affect eligibility—especially for Roth accounts or Traditional deductions.

Most problems arise when people contribute first and check rules later. A quick annual review before funding can prevent penalties and unnecessary corrections.

Disclaimer

This content is for general informational purposes only and does not provide financial, legal, medical, or investment advice.

Pro Insight

Over decades, the biggest threat to IRA performance isn’t market crashes—it’s abandoning a plan during uncomfortable periods.

Quick Tip

Schedule IRA contributions for the day after payday. When investing happens automatically, consistency becomes frictionless.

Habits that quietly weaken IRA investing

Frequent trading is one of the most common mistakes. IRAs aren’t built for short-term moves. Another issue is forgotten accounts after job changes, which leads to unbalanced portfolios over time.

A calm, once-a-year review is usually enough to stay aligned.

Frequently asked questions about IRA investing

Is IRA investing risky?

All investing carries risk, but diversified IRA strategies aim to reduce volatility over long periods.

Can I manage an IRA without an advisor?

Yes. Many investors manage IRAs directly through established online brokerages.

What happens if I exceed contribution limits?

Excess contributions may face penalties, but they can often be corrected if addressed promptly.

Can I move an IRA to a new provider?

Yes. Most IRAs can be transferred or rolled over without taxes if handled correctly.

Is IRA investing better than holding cash?

IRAs are designed for long-term growth, while cash is better suited for short-term needs.

Trusted U.S. sources

- https://www.irs.gov/retirement-plans/individual-retirement-arrangements-iras

- https://www.investor.gov/introduction-investing/investing-basics/retirement

- https://www.ssa.gov/retirement

IRA investing doesn’t promise excitement. It offers something more valuable—structure, tax efficiency, and time. For many Americans, that quiet reliability is exactly why it works.