Understand investment taxes, how different assets are taxed, and smart ways investors manage taxes legally.

Many investors focus on returns but overlook what truly determines success: investment taxes. What you earn on paper isn’t what you keep. Taxes quietly shape outcomes year after year, often more than market timing or stock selection.

Understanding how investment income is taxed helps you make clearer decisions, avoid surprises, and build wealth more efficiently over time.

What Investment Taxes Actually Cover

Investment taxes apply to income generated from assets like stocks, bonds, funds, real estate, and interest-bearing accounts. They don’t all work the same way.

For example, selling a stock for a profit triggers capital gains tax, while receiving dividends or interest may create taxable income even if you never sell anything. The timing, type of asset, and how long you hold it all matter.

A common real-life scenario: two investors earn the same return, but one pays far more in taxes simply because of how the return was generated.

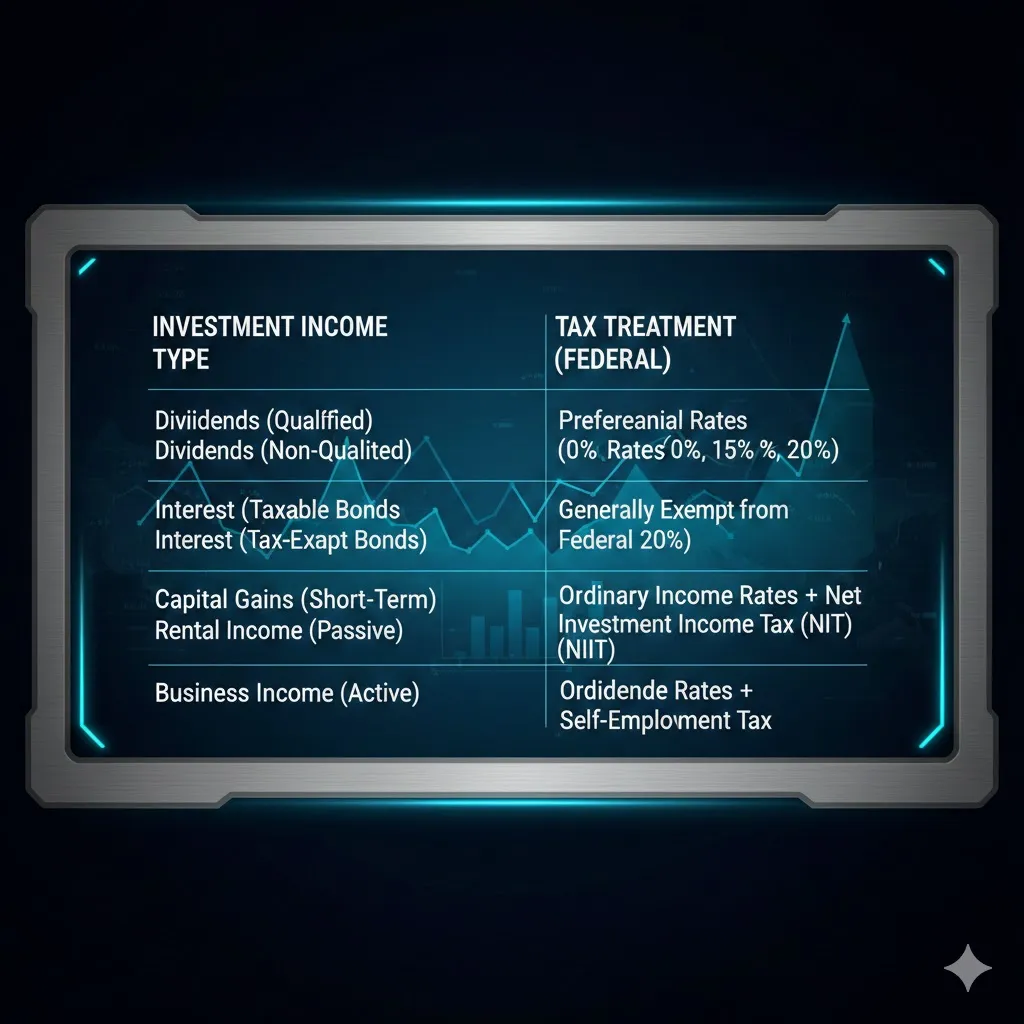

How Different Investment Income Is Taxed

Not all investment income is treated equally under U.S. tax rules.

Interest income is usually taxed as ordinary income. Dividends may be qualified or non-qualified, with different tax rates. Capital gains depend heavily on holding period—short-term versus long-term makes a major difference.

This structure rewards patience and planning, not constant trading.

Investment Tax Types Compared

| Income Type | Holding Requirement | Typical Tax Rate | Tax Efficiency |

|---|---|---|---|

| Short-term capital gains | 1 year or less | Ordinary income | Low |

| Long-term capital gains | Over 1 year | Reduced rates | High |

| Qualified dividends | Specific criteria | Reduced rates | High |

| Interest income | None | Ordinary income | Low |

| REIT distributions | None | Mostly ordinary | Low |

This comparison shows why how returns are earned matters as much as how much is earned.

How Taxes Affect Long-Term Growth

Taxes interrupt compounding. Every time gains are realized and taxed, less capital remains invested.

Consider an investor who trades frequently versus one who holds long term. Even if both achieve similar pre-tax returns, the frequent trader often ends with less after-tax wealth due to repeated tax friction.

Over decades, that difference can become substantial—without any change in market performance.

Common Mistakes Investors Make With Taxes

Many investors unintentionally create higher tax bills by selling too often, ignoring holding periods, or placing tax-inefficient assets in taxable accounts.

Another frequent mistake is focusing only on annual taxes instead of lifetime tax impact. Decisions made today can affect tax flexibility years down the line.

Good tax awareness isn’t about avoidance—it’s about alignment.

Disclaimer

This article is for general informational purposes only and does not constitute tax, legal, or financial advice. Tax rules vary by individual circumstances. Consult qualified professionals before making decisions.

Pro Insight

Reducing investment taxes often comes from structure, not strategy. Account choice and holding discipline usually matter more than chasing tax tricks.

Quick Tip

Before selling an investment, check whether waiting a few weeks could qualify it for long-term capital gains treatment.

Frequently Asked Questions

What are investment taxes?

They are taxes applied to income and gains generated from investments.

Are all investment gains taxed?

Most are, but rates and timing depend on asset type and holding period.

Do long-term investments pay less tax?

Often yes. Long-term capital gains typically receive lower tax rates.

Are dividends always taxed?

Most dividends are taxable, but qualified dividends are taxed at lower rates.

Can investment taxes be reduced legally?

Yes, through long-term holding, account placement, and thoughtful planning.

Conclusion

Investment taxes don’t grab headlines, but they shape real-world results. Investors who understand how returns are taxed—and plan accordingly—often outperform not by earning more, but by keeping more.

Clarity around taxes turns investing from a guessing game into a sustainable, long-term strategy.

Trusted U.S. Resources

Internal Revenue Service — Investment Income

https://www.irs.gov

U.S. Securities and Exchange Commission — Investor Education

https://www.sec.gov

FINRA — Tax Considerations for Investors

https://www.finra.org