Learn what derivatives trading is, how it works in 2026, key types, risks, and smart ways to trade with more control.

Derivatives trading sounds advanced, and honestly, it can be. However, the core idea is surprisingly simple: you’re trading a contract whose value depends on something else—like a stock, crypto, index, commodity, or currency.

That “something else” is called the underlying asset.

For example, instead of buying Bitcoin directly, you might trade a Bitcoin futures contract. You don’t own the coin, but you can profit (or lose) based on its price movement. Because of that, derivatives can feel faster, sharper, and more intense than spot trading.

Still, with the right approach, derivatives can also be a smart tool for hedging and risk control.

What Derivatives Trading Means in Plain English

A derivative is a financial contract that gets its price from an underlying asset.

Common underlying assets include:

- Stocks (like Apple or Tesla)

- Indexes (like the S&P 500)

- Commodities (like gold or oil)

- Forex pairs (like EUR/USD)

- Crypto (like BTC or ETH)

So, derivatives trading means you trade those contracts instead of the asset itself.

Real-life micro-scenario:

A trader believes oil prices will rise this week. Instead of buying oil directly, they trade an oil futures contract. If oil rises, the contract gains value. If oil drops, the contract loses value.

The Main Types of Derivatives You’ll See

Derivatives come in different forms. Each one has its own personality, risks, and use cases.

Futures Contracts

Futures are agreements to buy or sell an asset at a set price on a future date. They’re popular in commodities and crypto markets.

Futures can be used for:

- speculation (betting on price direction)

- hedging (protecting against price changes)

Options Contracts

Options give you the right (but not the obligation) to buy or sell an asset at a certain price before a certain date.

Options are often used for:

- hedging downside risk

- trading volatility

- building structured strategies

Swaps

Swaps are contracts where parties exchange cash flows. They’re more common in institutional finance, like interest rate swaps.

Perpetual Contracts (Perps)

Perpetual futures are common in crypto. They act like futures but don’t have an expiration date. Instead, they use a funding mechanism to keep prices aligned.

If you’re already trading perps, it helps to understand cross vs isolated margin because margin mode can change your liquidation risk dramatically.

Why Derivatives Trading Feels More Intense

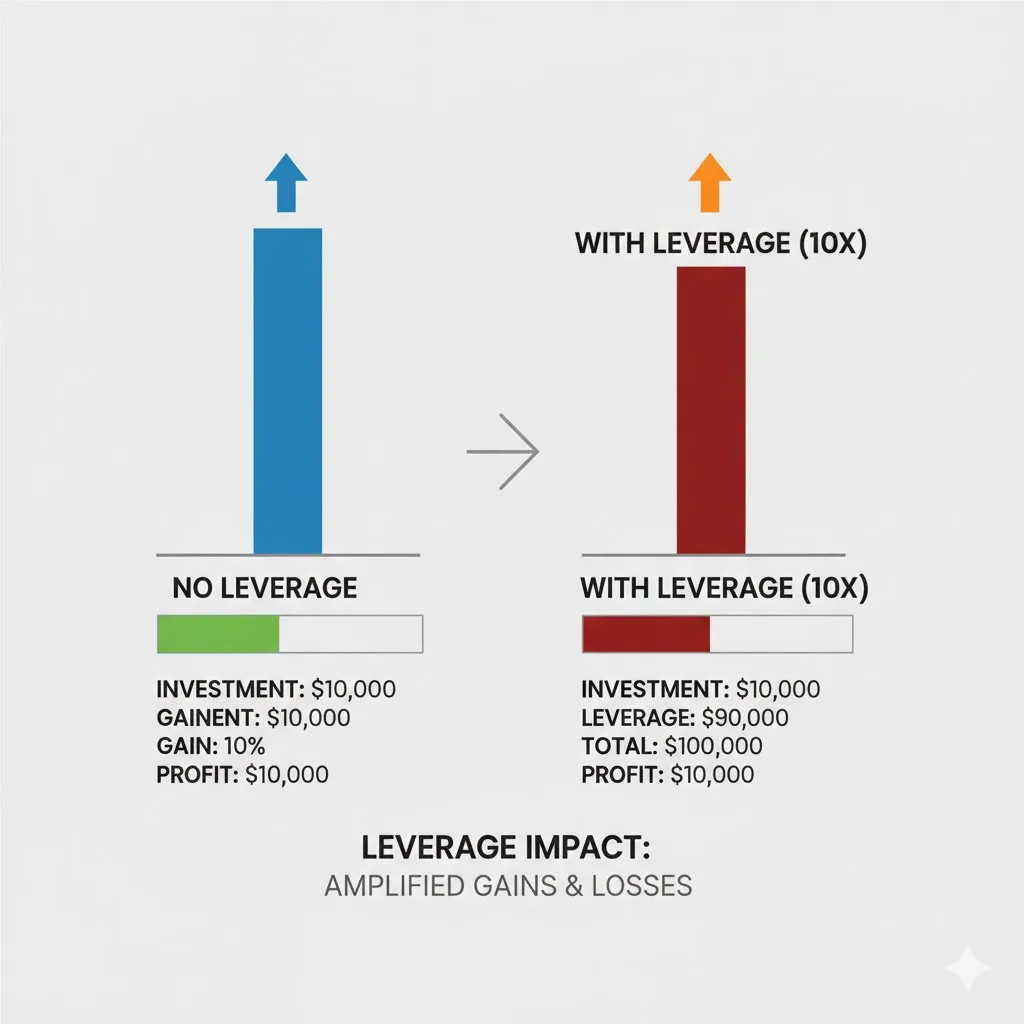

Derivatives often allow leverage, which magnifies both gains and losses.

That’s why derivatives trading can move faster than spot trading:

- you can open bigger positions with smaller capital

- liquidation can happen quickly

- fees and funding can impact results

Real-life micro-scenario:

A trader opens a 15x long on ETH because the chart looks bullish. ETH drops 4% quickly. The trade gets liquidated, even though the move wasn’t huge in normal terms.

That’s the leverage effect in action.

Derivatives Trading vs Spot Trading Comparison Table

| Feature | Spot Trading | Derivatives Trading |

|---|---|---|

| You own the asset | Yes | No (you own a contract) |

| Leverage available | Usually no | Often yes |

| Liquidation risk | None | Yes (if leveraged) |

| Complexity | Lower | Higher |

| Best for | Long-term holding | Active trading & hedging |

This table shows why derivatives trading is attractive—but also why it can punish mistakes faster.

The Biggest Risks in Derivatives Trading

Derivatives can be powerful, but the risks are real.

Leverage and liquidation

This is the most obvious risk. High leverage makes small market moves dangerous.

Funding fees (especially in crypto perps)

Even if price doesn’t move much, funding payments can slowly drain profits.

Overtrading

Because derivatives feel “fast,” many traders trade too often and burn their account through losses and fees.

Slippage and volatility spikes

During fast moves, your stop-loss might fill worse than expected.

If you want to stay consistent, a risk management checklist and a position sizing guide can help you avoid common blow-ups.

Pro Insight

Many profitable derivatives traders focus less on prediction and more on survival. Their edge often comes from position sizing and exit discipline, not perfect entries.

Smart Ways to Trade Derivatives Without Getting Burned

You don’t need to avoid derivatives completely. However, you do need structure.

Use isolated margin when possible

This limits the damage of one trade and protects the rest of your funds.

Reduce leverage

Lower leverage gives your trade breathing room. It also reduces emotional pressure.

Plan your exit before entering

A good trade has:

- entry reason

- stop-loss level

- profit target

- invalidation point

Trade fewer, better setups

Quality beats quantity. Trading all day often increases mistakes.

Quick Tip

If you’re new to derivatives, try using 2x–5x leverage first. It still gives exposure, but it’s far easier to manage emotionally.

FAQs About Derivatives Trading

Is derivatives trading the same as futures trading?

Futures are one type of derivative. Derivatives also include options, swaps, and other contracts.

Can you lose more than your deposit in derivatives trading?

It depends on the platform and product. Some systems liquidate early to limit losses, but risks can still be high.

Why do traders use derivatives instead of spot?

They use derivatives for leverage, hedging, and the ability to profit from both rising and falling markets.

Is derivatives trading only for professionals?

Not only, but beginners should start slowly. The learning curve is steeper than spot trading.

What’s the safest way to start derivatives trading?

Start small, use isolated margin, use low leverage, and trade only setups you understand.

Disclaimer

Trading involves risk and may result in losses. This article is for informational purposes only and does not provide financial, legal, or investment advice. Always trade based on your own risk tolerance.