Blue-chip stocks are the backbone of many successful American investment portfolios. They’re known for stability, strong earnings, reliable leadership, and the ability to weather economic storms. In 2025—an era of rising interest rates, AI expansions, and shifting global markets—blue-chip stocks remain one of the smartest long-term strategies for both beginners and seasoned investors.

For informational purposes only — not financial or legal advice.

Think of blue-chips like the financial equivalent of a well-built home in a good neighborhood: stable, dependable, and likely to appreciate over time. This guide walks you through everything you need to know to invest confidently.

What Are Blue-Chip Stocks?

Blue-chip stocks are shares of large, financially strong, industry-leading companies with:

- Long histories of profitability

- Stable balance sheets

- Predictable earnings

- Strong brand value

- Reliable dividends

Examples include Apple, Microsoft, Johnson & Johnson, Coca-Cola, and Costco.

These companies don’t just survive turbulent markets—they often lead recoveries.

Why Blue-Chip Stocks Matter in 2025

1. Stability During Market Volatility

Blue-chips provide balance in uncertain markets.

2. Reliable Long-Term Growth

They deliver steady compounding returns over decades.

3. Strong Dividend Income

Many pay dividends—and increase them annually.

4. Lower Risk Than Small-Cap Stocks

Financial strength shields them during recessions.

5. Core Portfolio Foundation

Great for retirement accounts, IRAs, and 401(k)s.

If you want an investment that grows quietly and consistently, blue-chips are essential.

Top Blue-Chip Sectors (2025)

Technology

- Apple (AAPL)

- Microsoft (MSFT)

- Nvidia (NVDA)

Leaders in AI, cloud, and chips.

Consumer Staples

- Coca-Cola (KO)

- Procter & Gamble (PG)

Resilient through all economic cycles.

Healthcare

- Johnson & Johnson (JNJ)

- Pfizer (PFE)

Stable demand + dividends.

Financials

- JPMorgan Chase (JPM)

Strong balance sheets and global presence.

Retail & Membership Clubs

- Costco (COST)

Loyal customers + strong profitability.

Pros & Cons of Blue-Chip Stocks

Advantages

- Lower risk

- Strong liquidity

- Steady price appreciation

- Reliable dividends

- Ideal for long-term strategies

Limitations

- Slower growth than small caps

- Large company size reduces explosive potential

- Priced at a premium

Blue-chips aren’t for quick wins—they’re for steady, predictable wealth.

How to Start Investing in Blue-Chip Stocks

Step 1 — Choose a Brokerage

Beginner-friendly U.S. options:

- Fidelity

- Vanguard

- Charles Schwab

- Robinhood

- E*TRADE

Step 2 — Buy Fractional Shares

High-priced companies like Apple or Costco can be purchased in fractions, starting at $1.

Step 3 — Build a Core Portfolio

A simple beginner setup:

- 40% Tech blue-chips

- 30% Consumer staples

- 20% Healthcare

- 10% Financials

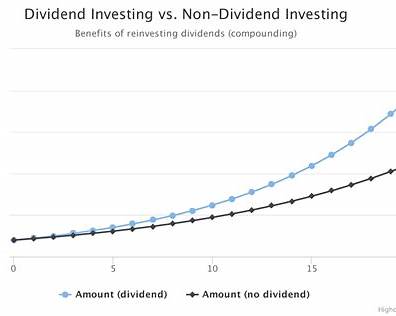

Step 4 — Add Dividend Reinvestment (DRIP)

Automatically reinvest dividends to accelerate compounding.

Blue-Chip Stocks vs Other Investments

Compared to Growth Stocks

- Blue-chips = stable, predictable

- Growth = higher risk, higher upside

Compared to Small Caps

- Blue-chips = safer during downturns

- Small caps = more volatile

Compared to Bonds

- Blue-chips = better long-term returns

- Bonds = lower risk, lower reward

Quick Tip:

Combine blue-chips with ETFs for a balanced, smart portfolio.

Pro Insight: Blue-Chip Dividends Build Real Wealth

Many blue-chip companies increase dividends every single year.

These are called Dividend Aristocrats.

Reinvested dividends can account for 30–40% of total returns over decades.

If you want a “quiet wealth machine,” dividend blue-chips deliver it.

Comparison Table: Blue-Chip Investing (2025)

| Feature | Benefit | Cost | Notes |

|---|---|---|---|

| Dividend Stocks | Income + growth | Medium | DRIP boosts compounding |

| Tech Blue-Chips | Innovation | Medium–High | Strong 2025 performance |

| Consumer Staples | Stability | Low | Recession-resistant |

| Healthcare Leaders | Consistent demand | Low–Medium | Long-term essential |

| Financial Blue-Chips | Dividend strength | Medium | Sensitive to rates |

Frequently Asked Questions

Are blue-chip stocks good for beginners?

Yes. They’re stable, widely trusted, and ideal for long-term growth.

Can blue-chip stocks lose value?

Yes, in the short term. But historically, they recover faster than smaller companies.

Do I need a lot of money to buy blue-chip stocks?

No. Fractional shares let beginners start with $1.

Are blue-chip dividends reliable?

Many increase dividends annually, providing steady income.

Should blue-chips be my whole portfolio?

They should be a core part, but diversification still matters.

External Authority Sources

https://www.consumerfinance.gov

https://www.usa.gov

https://www.census.gov