A practical 401k strategy for 2026 to grow retirement savings faster, avoid common mistakes, and invest with more confidence over time.

A smart 401k strategy isn’t about finding the “perfect” fund. It’s about building a system you can stick with through good markets and bad ones. The 401(k) is one of the strongest retirement tools in the U.S., especially when your employer offers a match. Still, many people waste years by contributing too little, picking random investments, or panicking during downturns.

For example, two coworkers can earn the same salary and have completely different retirement outcomes. One follows a simple plan and stays consistent. The other changes funds constantly and stops investing during market dips. The difference isn’t intelligence—it’s strategy.

Start With the Employer Match First

If your employer offers a match, this is usually the easiest win in personal finance.

A match is extra money added to your 401(k) when you contribute. If you don’t contribute enough to get it, you’re leaving part of your compensation behind.

Real-life micro-scenario:

A worker contributes 3% because it “feels safe.” Their employer matches up to 6%. That means they’re missing free money every paycheck.

A strong first step is to contribute at least enough to capture the full match.

Choose a Simple Investment Approach

Many 401(k) plans offer dozens of funds. Still, you don’t need a complicated mix to do well.

Option 1 Target-date fund

This is often the simplest choice. It automatically adjusts risk over time based on your expected retirement year.

Option 2 Basic diversified mix

Some investors choose a mix like:

- a broad U.S. stock fund

- an international stock fund

- a bond fund

This can work well if you want more control. However, simplicity usually wins long-term.

If you’re still building your foundation, a retirement investing guide can help you understand why steady diversification matters more than chasing trends.

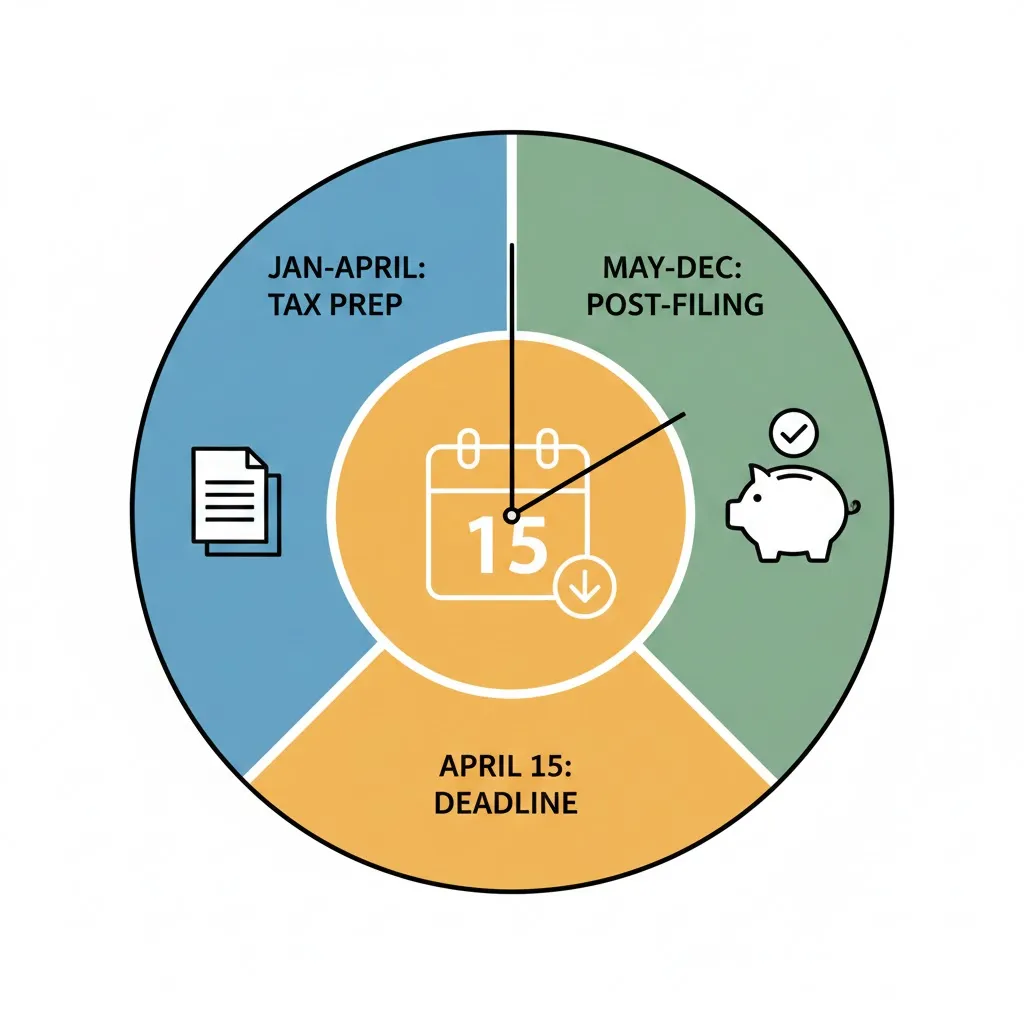

The 401k Contribution Strategy That Works Best

A practical approach is to increase contributions gradually instead of trying to jump too high immediately.

Many people use:

- start with a comfortable percentage

- increase 1% each year

- raise it again after raises or bonuses

This keeps your lifestyle stable while your retirement savings grows.

Real-life micro-scenario:

A worker contributes 6% today. After a raise next year, they increase to 7%. Over time, this becomes a powerful habit without feeling painful.

Traditional vs Roth 401k Strategy

Choosing between Traditional and Roth is a common stress point. Still, you don’t need to overthink it.

| Feature | Traditional 401(k) | Roth 401(k) |

|---|---|---|

| Tax timing | Tax break now | Tax-free later |

| Pay taxes now | No | Yes |

| Pay taxes later | Yes | No |

| Best for | Higher earners today | Lower earners today |

| Flexibility | Strong | Strong |

Some people split contributions between both. That creates flexibility later.

The Biggest 401k Strategy Mistakes

Not increasing contributions over time

Many people stay stuck at the same contribution rate for years. That slows growth.

Picking funds without checking fees

High fees can quietly reduce long-term returns.

Panic-selling during market drops

Selling after a crash locks in losses. Staying consistent often works better.

Borrowing from the 401(k) too often

Loans can disrupt compounding, even if you “pay yourself back.”

Pro Insight

The most effective 401(k) strategy is consistency. People who keep contributing during down markets often benefit the most when markets recover.

A Simple 401k Strategy You Can Follow in 2026

Here’s a clean plan that works for most people:

Step 1 Contribute to get the full match

This is the foundation.

Step 2 Pick one simple investment option

A target-date fund is often the easiest.

Step 3 Increase contributions slowly

Raise your percentage over time.

Step 4 Rebalance occasionally

If you manage your own mix, rebalance once or twice per year.

If you’re aligning this with other goals, a financial planning checklist can help you stay organized.

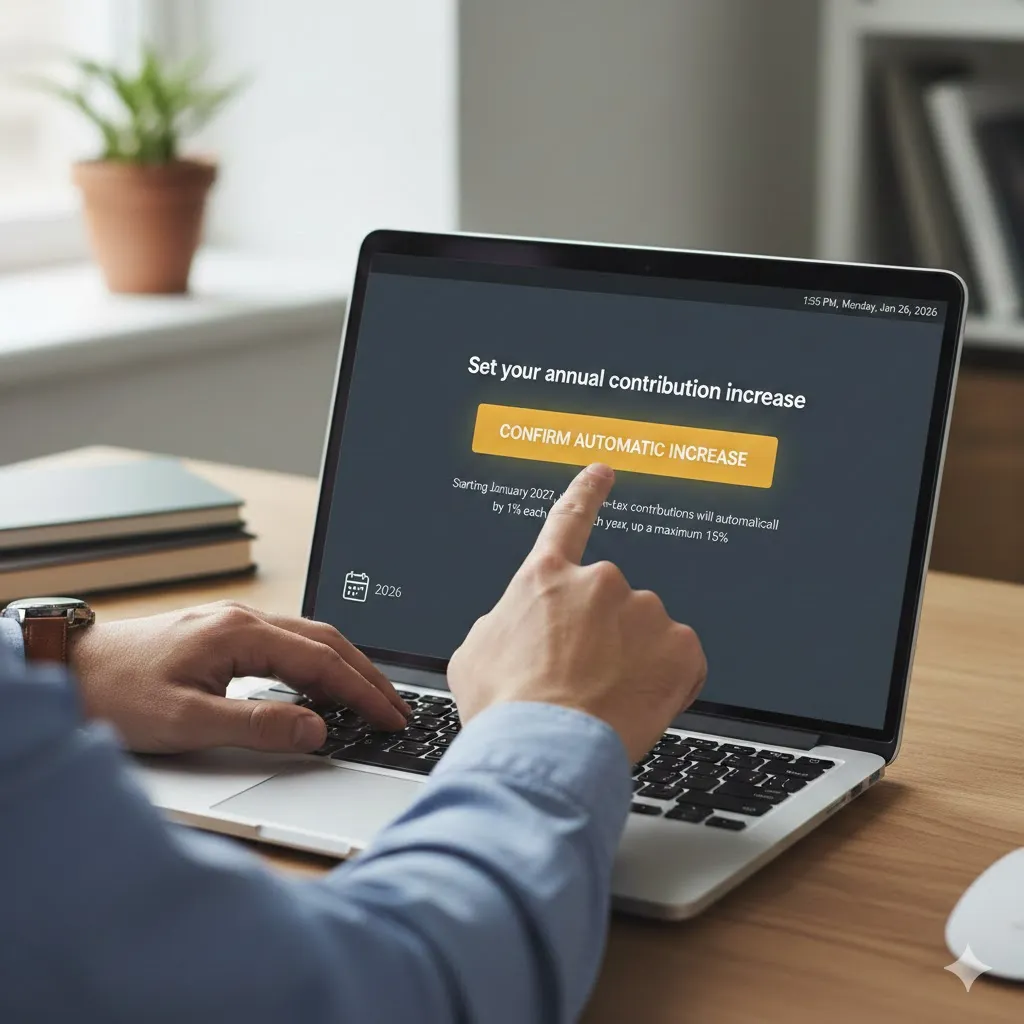

Quick Tip

Turn on automatic annual contribution increases if your plan offers it. It’s one of the easiest ways to grow your 401(k) without feeling it.

FAQs About 401k Strategy

How much should I contribute to my 401(k)?

Start with enough to get the employer match, then increase over time as your budget allows.

Should I choose Roth or Traditional 401(k)?

It depends on your current income and future expectations. Some people split between both for flexibility.

Is a target-date fund a good option?

For many people, yes. It’s simple, diversified, and adjusts risk automatically.

How often should I change my 401(k) investments?

Not often. Frequent changes can lead to emotional decisions. Many investors review once or twice per year.

Can I lose money in a 401(k)?

Yes. Investments can drop in value. However, long-term consistency often reduces the impact of short-term declines.

Disclaimer

This article is for general informational purposes only and does not provide financial, legal, or tax advice. Investing involves risk, including possible loss of principal.